He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

Understanding Prop Firm Rules: Drawdown Limits, Profit Targets, and More

Decoding the Fine Print Before It Decodes Your Trading Career

Let me be straight with you.

Most traders don’t fail prop firm challenges because their strategy is broken.

They fail because they didn’t read the rules—or worse, they read them but didn’t truly understand how those rules behave under live market pressure.

I’ve been trading for 18 years.

I’ve passed multiple evaluations, blown funded accounts, mentored dozens through their prop firm journeys—and here’s one thing that holds true every single time:

👉 Your success in a prop firm isn’t about how much you know.

It’s about how well you follow their rules—to the letter.

So today, let’s decode those rules:

The obvious ones, the sneaky ones, and the ones buried in the fine print or forgotten FAQs.

Whether you’re trading futures with Apex, Leeloo, or Topstep—or diving into forex or crypto funding—this guide will help you protect your account, your psychology, and your capital.

🎯 And if you want to prepare the right way before even taking a challenge, start with practical, mindset-driven trading classes near me that teach you not just how to trade—but how to last.

The Core Rulebook: What Prop Firms Expect from Traders

Before you even click “Buy Challenge”, every prop firm outlines a set of risk management conditions. These aren’t suggestions—they are non-negotiable terms.

Break one?

Game over—account invalidated, no refund, back to square one.

Let’s break down the key rules one by one.

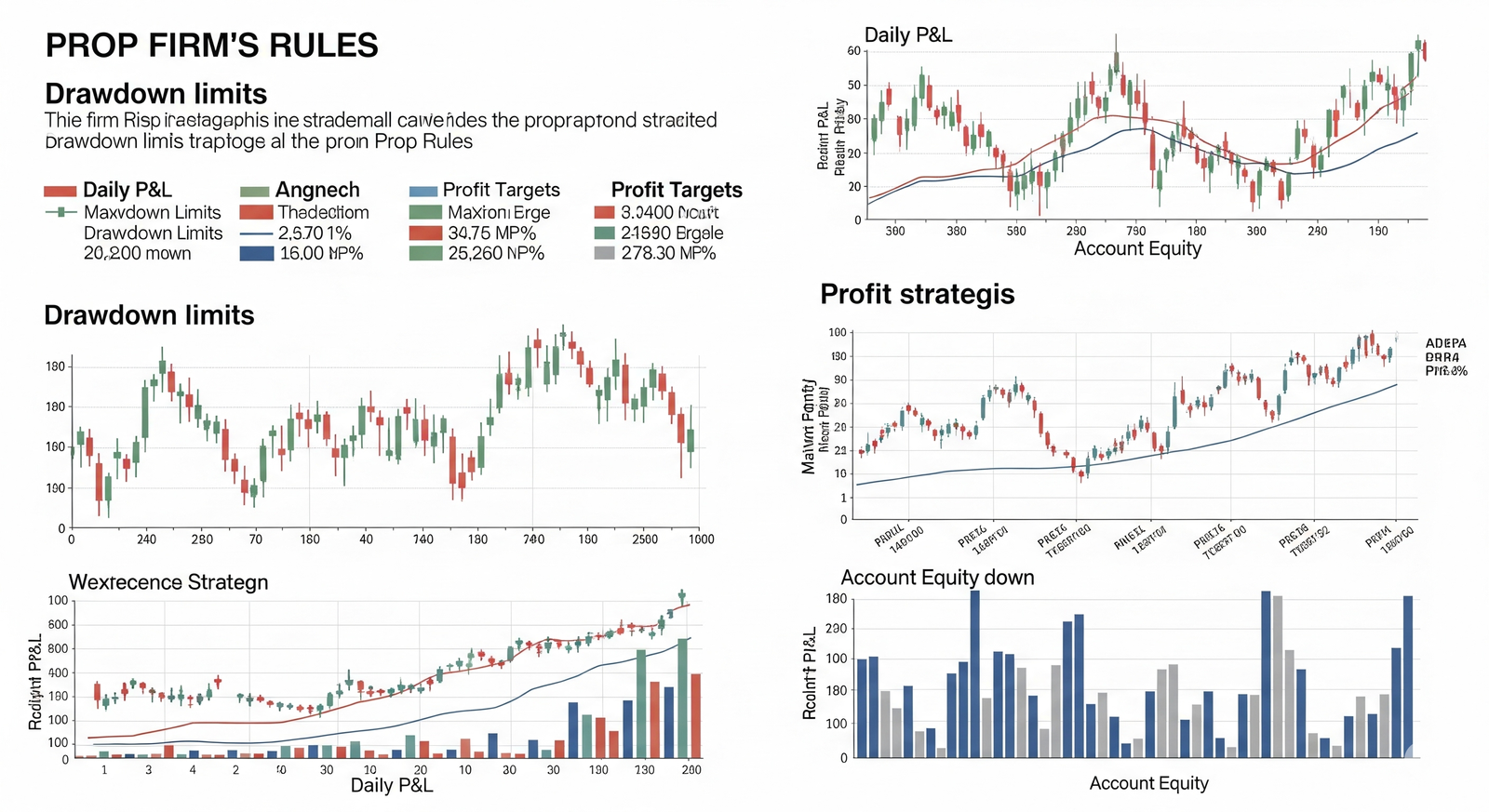

1. Total Drawdown Limit (Max Loss)

What it is:

The maximum amount your account balance can drop—cumulatively—before your challenge or funded account is terminated.

Example:

You get a $50,000 account with an 8% drawdown limit.

That means you can’t go below $46,000 at any point, including open trades.

Why it matters:

Many traders think, “I’ll just hold and wait for the market to come back.”

But in prop trading, you don’t get that luxury. Even unrealized losses count. A few oversized trades, and your funded journey ends overnight.

🔥 2. Intraday Drawdown (Daily Loss Limit)

What it is:

The maximum amount you can lose in a single trading day.

Example:

On a $100K account with a 5% daily loss cap, your total daily loss cannot exceed $5,000, including both closed trades and floating losses.

Some firms count realized P&L only, while others consider uhttps://propfirmmatch.com/prop-firm-rulesnrealized losses as well—even if you recover later in the day.

Common Mistake:

You start the day up $1,000 and think you have “buffer.” But you lose $5,500 next trade—bringing net to -$4,500. But your intraday drawdown? Still -$5,500. You’re done.

🧨 3. Trailing Drawdown (The Silent Killer)

Ah, the infamous trailing drawdown. This is where most traders trip up—especially in futures-based prop firms.

There are two types:

🔸 Intraday Trailing Drawdown

It adjusts tick-by-tick or trade-by-trade, based on your account balance (not equity), and tightens as your balance increases.

Example:

Start: $50,000

Max trailing drawdown: $2,500 (i.e., can’t drop below $47,500)

You grow the account to $52,000 → trailing moves up to $49,500

You drop back to $48,900? Account breached—even though you’re in profit overall.

🔸 EOD (End of Day) Trailing Drawdown

This version calculates trailing only at end of the day, offering more breathing room for intraday fluctuations.

Pro Tip:

Always confirm with your firm—is it balance-based or equity-based trailing?

This makes a huge difference in how you manage floating trades and exits.

📈 4. Profit Targets

What it is:

The minimum profit you need to generate during the challenge phase.

Typical targets:

- $3,000 on a $50K account

- $6,000 on a $100K account

- $9,000 on a $150K account

But here’s the twist:

It’s not just about hitting the target. You also have to do it without breaking the other rules—drawdowns, risk per trade, etc.

This is where emotional control becomes everything.

📊 5. Consistency Rule

This is a sneaky little clause that trips up aggressive traders.

What it means:

You can’t make all your profit in one or two big trades. Most firms want you to show consistent performance over time.

Example:

You hit your $3,000 target in one trade. But 90% of your profit came from one day.

Firm says: “Sorry, no funding. You’re not consistent.”

Best practice?

Take it slow. Aim to make 5–10% over 10+ trading days.

Trade small. Stack wins. Show control.

🌐 6. IP Restrictions and Account Integrity

You’re probably thinking, “This is about trading. Why do IP addresses matter?”

Here’s why:

Prop firms use IP and device tracking to prevent:

- Account sharing

- Bot usage

- Multi-accounting

- Fraudulent access from restricted regions

Don’t do this:

- Log in from your laptop, then ask your cousin in Dubai to “just check something” from his phone

- Use VPNs to access from blocked countries

- Run EA bots or copiers without written permission

Do this instead:

- Stick to one device and one network (as much as possible)

- If you travel, inform the firm in advance

- Use firm-approved trade copiers or third-party tools

Warning:

Even if you’re profitable, a violation of IP/device policy can get your account banned without payout.

🧭 Summary of Key Rule Types by Category

| Rule Type | Applies To | Notes |

| Total Drawdown | Challenge & Funded | Absolute line in the sand. Breach = termination. |

| Intraday Drawdown | Challenge & Funded | Includes floating losses. Watch your open P&L. |

| Trailing Drawdown | Mostly Futures Firms | Moves with balance. Some are EOD-based. |

| Profit Target | Challenge Only | Must be hit without breaking other rules. |

| Consistency Rule | Some Firms | Spread profit across multiple days. |

| IP Restrictions | All Firms | Avoid multi-logins, VPNs, sharing. |

🧠 Emotional Traps Traders Fall Into

Trading under prop firm rules isn’t just about following the manual—it’s about understanding prop firm rules navigating your own psychology.

Here are the most common traps I’ve seen traders (including myself) fall into:

- “I’m so close to target, let me size up.”

You oversize. One wrong candle. Done. - “I made $1,200 yesterday, so I have room to risk today.”

You lose $2,500. Your average is now off. Consistency broken. - “Trailing is too tight—I’ll just hold through it.”

Market dips 1 tick below drawdown. Trade reverses in your favor—but you’re already disqualified. - “I’m profitable. They won’t care about rules.”

They do. And they’ll cancel your account without apology.

💼 Prop Firm Rules in Futures Trading: Special Notes

If you’re trading futures through prop firms (like Apex, Topstep, Leeloo), you need to be extra vigilant:

- Futures tick sizes are large. A 10-tick loss in NQ = $200

- Trailing drawdown is often intraday, balance-based

- Some contracts (like Crude Oil or Natural Gas) have huge volatility, understanding prop firm rules, easily triggering drawdown breaches

- News trading in futures can be banned during FOMC, CPI, NFP—check your firm’s calendar

Advice from experience:

If you’re up $1,000 on a $50K futures account—take it and walk. Protecting your profit is as important as earning it.

✅ How to Stay Funded Long-Term

Passing the challenge is just the start. Staying funded is the real game.

Here’s how I’ve helped traders stay funded for months (and even scale up):

- Trade small, even when funded

Don’t increase risk just because you “made it.” - Set your own personal daily loss cap

Make it tighter than the firm’s. - Track trailing drawdown like your life depends on it

Use spreadsheet calculators. Don’t eyeball. - Don’t trade when emotional

Lost a funded account after an argument with your spouse?

It’s more common than you think. - Rest when needed

This is a marathon—not a dopamine rush.

🔚 Final Thoughts: Know the Rules, Win the Game

Here’s something I remind every new trader joining a prop journey:

“Your strategy doesn’t need to be genius. It just needs to respect the rules.”

You could be 70% accurate, pulling 1:2 R:R trades…

But if you break one drawdown rule, take one oversized revenge trade, understanding prop firm rules, or forget to log out on time—that’s it. Game over.

Trading a prop firm account is like flying a plane under strict air traffic control.

You can go far—but only if you obey every signal, every altitude, every checkpoint.

📘 So read the rules. Re-read them.

Make them part of your trading DNA.

Because the traders who succeed long-term with prop firms?

They aren’t the wildest risk-takers.

They’re the ones who know the fine print like scripture.

🎯 Want to build that mindset before you ever touch a challenge account?

Start with experience-first stock trading classes that teach you how to trade with discipline, structure, and real-world readiness.