He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

Top 5 Things to Look For When Choosing a Prop Firm

An Experienced Trader’s Personal Guide to Picking the Right Prop Firm

Let’s be honest—if you’re new to the prop trading world, it can feel overwhelming.

The ads are everywhere:

💰 “Get funded up to $500,000!”

🚀 “Make money without risking your own capital!”

🙌 “No experience? No problem!”

Sounds great, right?

But here’s the truth: not all prop firms are created equal.

And if you choose the wrong one, it doesn’t matter how solid your strategy is—you’ll be set up to fail before you even begin.

As someone who’s spent 18 years in the markets, I’ve seen this industry evolve—from niche trading desks to a booming online prop ecosystem.

I’ve watched firms rise to glory—and others disappear overnight, taking traders’ payouts and dreams along with them.

So today, I want to give you something no ad or affiliate link will: the truth.

And if you’re still finding your feet in this fast-moving world, don’t underestimate the value of solid mentorship.

Start with expert-guided trading classes in Kothrud to build clarity and confidence before risking your time—or your trust—on the wrong firm.

Here are the 5 most important things you need to check before choosing a prop firm.

1. Reputation and Credibility

This one’s a deal-breaker. If the firm doesn’t have a solid reputation, walk away—no matter how attractive the offer sounds.

What to Look For:

- Trader Reviews: Check Trustpilot, Reddit, Discord communities. Are traders getting paid on time? Are accounts being unfairly terminated?

- Longevity: Is the firm relatively new, or have they been around for 2–3 years? Longevity usually means they’ve weathered challenges and aren’t just cash-grabbing.

- Transparency: Does the firm clearly explain its rules, policies, and payout structures? Are their terms easily accessible?

Red Flags:

- Vague or confusing refund/payout policies

- Bad customer support experiences

- Unusual number of traders complaining about sudden account closures

- No clear company registration or legal identity

Personal Note:

I remember trying a firm in 2021 that had a clean website and good marketing—but no real history. I passed the challenge, made profits, and then… crickets. No response. They shut down 3 months later. Lesson learned.

2. Rules and Evaluation Conditions

A prop firm may offer a huge payout—but if their rules are too restrictive, you’ll never see that money.

Key Rules to Evaluate:

- Max Daily Drawdown: Is it realistic for your style? (Most offer 4–5%)

- Overall Drawdown Limit: Usually 8–10%—check if it’s equity-based or balance-based. It matters.

- Minimum Trading Days: Some require 5 or more days to pass even if you hit the profit target early.

- Consistency Requirements: Are there hidden conditions like not making 80% of profits in a single day?

Hidden Pitfalls:

- Weekend Holding Restrictions

- News Trading Restrictions

- Trailing Drawdown vs Static Drawdown

Trader Tip:

Match the firm’s rules to your trading style. If you’re a swing trader, don’t pick a firm that forces you to close trades before the weekend. If you’re a scalper, choose firms with low latency and tight spreads.

3. Profit Split and Payout Structure

This is what everyone focuses on—but few people read the fine print.

Sure, “90% profit split” sounds amazing… but how is it paid? How soon can you withdraw? Are there rules tied to your first payout?

Look For:

- Clear Payout Cycles: Weekly, bi-weekly, or monthly? Some even offer payouts after just 10 days of being funded.

- Payout Methods: Wise, Deel, crypto, PayPal? Is it accessible in your country?

- Profit Split Structure: Some firms start at 70% and scale you up to 90% as you prove yourself.

Watch Out For:

- Delayed payouts after passing the challenge (e.g., “must trade 30 days before payout”)

- Firms that limit your first withdrawal amount

- Fees on withdrawals or minimum withdrawal thresholds

Real Story:

One of my mentees made $2,000 in the first month of funding with a new firm—but couldn’t withdraw it because they hadn’t completed “20 active trading days.” That’s why reading the fine print matters more than the marketing headline.

4. Platform Stability and Trading Conditions

This is one of the most underrated factors. Imagine nailing your setup… and your platform freezes. Or your trade gets slipped 10 pips because of poor server performance.

If the platform doesn’t work smoothly, your edge gets destroyed.

What You Should Check:

- Execution Speed: Is the platform responsive? Is there server lag during peak hours?

- Broker & Spreads: What broker or liquidity provider does the firm use? Are spreads reasonable?

- Simulated vs Live Accounts: Are you really trading on live markets, or simulated ones? This affects slippage and fills.

- Permitted Strategies: Can you scalp? Can you hold trades overnight?

Tech Red Flags:

- Prop firms that use unregulated offshore brokers

- Servers crashing during high-impact news events

- Unexplained slippage on normal pairs during calm markets

My Own Frustration:

Once during NFP, I entered a perfectly timed gold trade. On my regular broker, it got filled. On the prop firm’s simulator? It skipped right past the entry and then flagged me for news trading. I’d followed the rules—but the tech failed me.

5. Scaling Plan and Long-Term Trader Support

A good prop firm isn’t just looking to test you—they want to build a relationship with consistent traders.

Scaling plans reward consistency by increasing your capital over time. If you’re profitable and follow rules, your $50K account could grow to $200K or more.

Signs of a Supportive Prop Firm:

- Clear Scaling Milestones

(e.g., every 2–3 months, account size increases by 25% if targets are hit) - Performance Bonuses

Some firms offer cash bonuses for consistency. - Loyalty Tiers

As you stay longer and perform well, you may get lower fees or better splits.

Be Careful If:

- The firm has no mention of scaling

- There’s no trader support or account manager access

- You can’t find real trader success stories with long-term growth

Veteran Insight:

The real power of prop firms is not in the one-time payout—it’s in building a stable, scalable income stream over time. Find a firm that wants to grow with you, not just extract challenge fees from you.

Bonus Tip: Check the Vibe of the Community

You can learn a lot from a firm’s community—if they have one.

1. Are traders helping each other?

2. Are payouts being shared in public?

3. Are people warning each other of issues?

Or is it just a dead Discord group with fake testimonials?

A good community is often a mirror of a good firm.

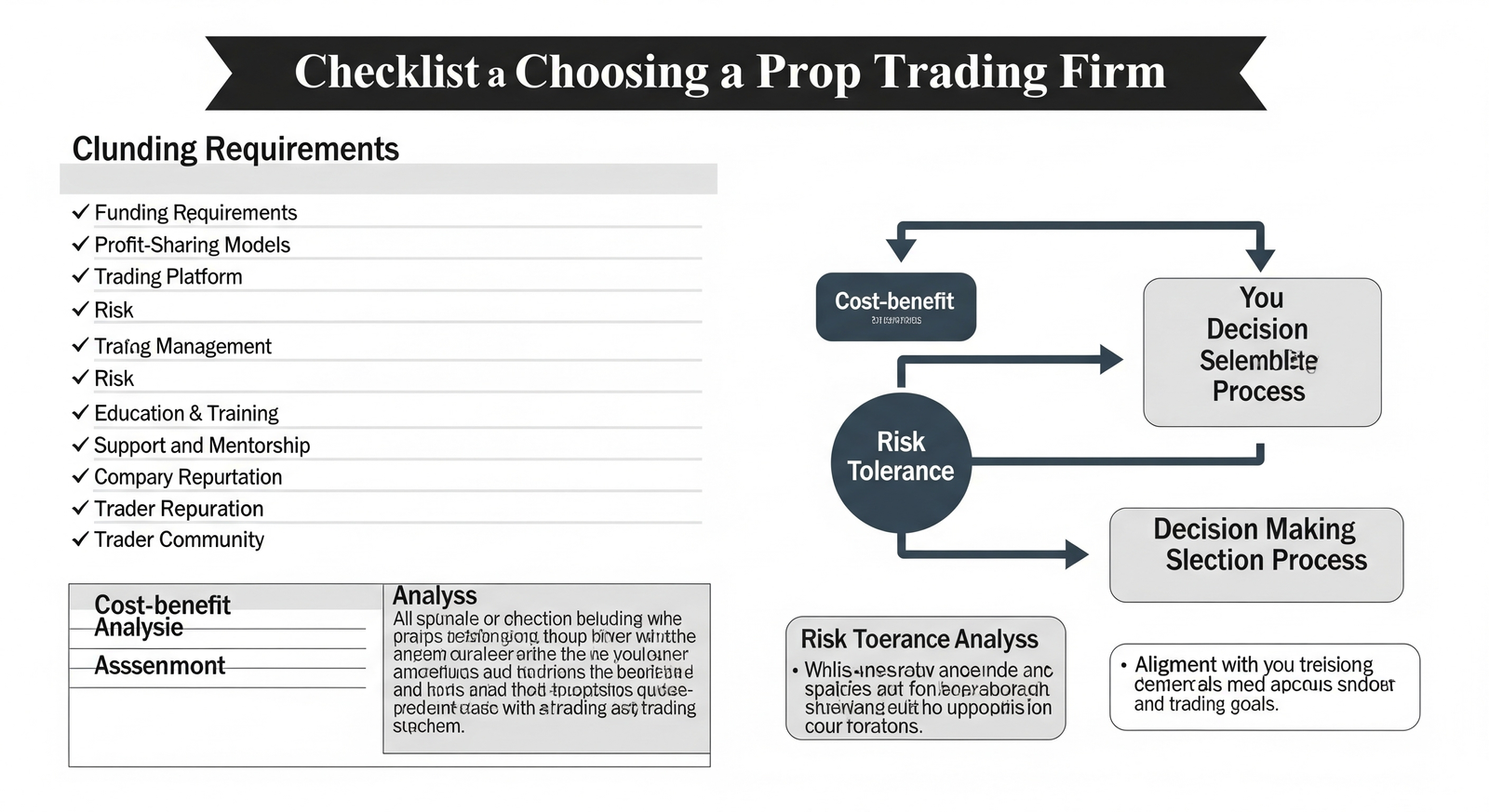

Quick Checklist Before Signing Up

1) Is the firm reviewed positively and transparently?

2) Are the rules trader-friendly and well explained?

3) Is the payout structure fair and accessible?

4) Are the trading conditions stable and realistic?

5) Do they offer long-term growth through scaling?

If the answer to all five is YES—you may have found a prop firm worth trusting.

Final Thoughts: Choose the Firm That Suits You

There’s no perfect firm. There’s only the firm that fits your style, your goals, and your values.

If you’re a sniper—precise, patient, consistent—look for firms that reward discipline and precision.

If you’re a fast, high-volume scalper, find firms with tight spreads, better execution, and fewer restrictions.

But above all: Don’t rush.

🚫 Don’t get swayed by flashy payouts or cheap entry fees.

✅ Do your homework.

✅ Protect your energy.

✅ And most importantly—protect your confidence.

Because in this game, the firm you choose becomes your trading partner.

And not all partners are worth trading with.

Want to approach this with clarity and confidence?

Start with solid, no-nonsense share trading courses in Kothrud that prepare you for real decisions, not just demo-day dreams.