He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

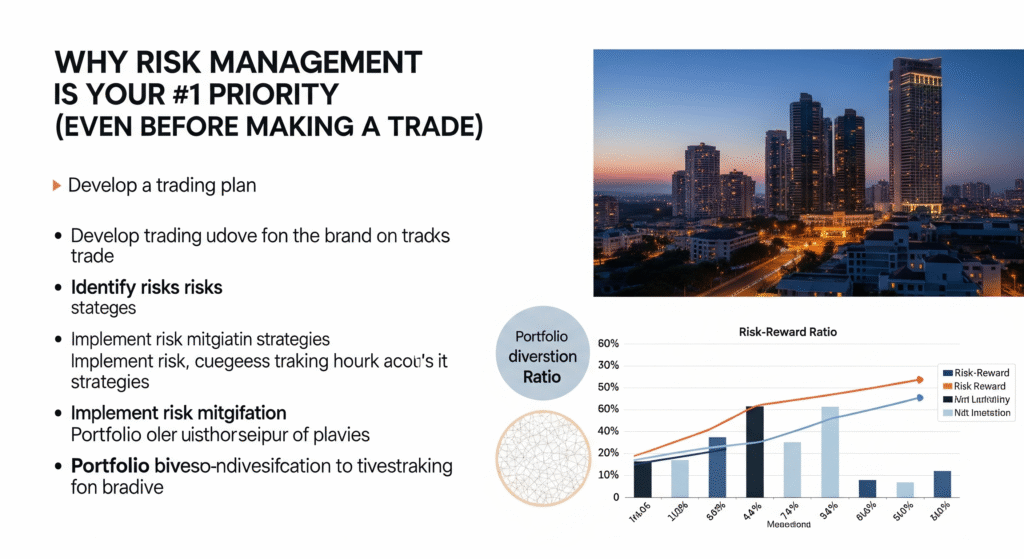

Why Risk Management is Your 1 Priority (Even Before Making a Trade)

I didn’t understand this when I started trading 18 years ago. Like many beginners, I was obsessed with perfect entries, trying to catch tops and bottoms, and chasing indicators that promised flawless signals. I thought being right was the game.

And then I lost… again and again.

It took me a blown account and several painful drawdowns to finally understand that profitability doesn’t come from winning trades—it comes from managing losing ones.

Let me show you why risk management isn’t just important—it’s the foundation of everything in trading.

Your primary duty as a trader is to manage your risk. You get paid only when you do your duty. It’s as simple.

💥 The Myth of the “Perfect Trade”

Every trader, especially in the early stages, dreams of that perfect trade:

- The stock that doubles in a week

- The forex pair that swings 100 pips in your direction

- The breakout that never pulls back

But let me be brutally honest: Perfection doesn’t exist in the markets.

Even the most well-researched setup can fail. Markets are dynamic, irrational, and unforgiving to those who aren’t prepared for the unexpected.

That’s where risk management steps in—not as an afterthought, but as your first line of defense.

“It’s not about how much you make, it’s about how much you keep.”

— Paul Tudor Jones

🛡️ What is Risk Management in Trading?

Risk management is the process of identifying, controlling, and minimizing the potential losses in your trades.

It includes:

- How much you risk per trade

- Where you place your stop loss

- The size of your position

- The overall risk exposure on your account

In simple terms: It’s about making sure no single trade can blow up your capital.

⚖️ The Power of the Risk:Reward Ratio

Before you even hit the “Buy” or “Sell” button, you need to ask one critical question:

“Is the potential reward worth the risk I’m about to take?”

This is where the Risk:Reward Ratio (RRR) comes in.

🔍 What is Risk:Reward Ratio?

It’s a simple metric that compares how much you’re risking to how much you aim to make.

- If you risk ₹1,000 to potentially make ₹3,000, that’s a 1:3 risk:reward.

- If you risk ₹500 to make ₹1,000, that’s 1:2.

The beauty of a strong RRR is this:

👉 Even if you’re right only 40% of the time, you can still be profitable—because your wins are bigger than your losses.

| Risk:Reward | Win Rate Needed for Profitability |

| 1:1 | > 50% |

| 1:2 | 33% |

| 1:3 | 25% |

This was a game-changer for me. Once I shifted from trying to be “right” to only taking trades where the potential reward dwarfed the risk, my equity curve began to stabilize.

📊 Understanding the R-Multiple

Another way to track your performance is by using the R-Multiple.

💡 What is R-Multiple?

“R” stands for the amount you risk per trade.

If your stop loss is ₹1,000, that is 1R.

So if you:

- Lose ₹1,000 → You lost -1R

- Make ₹2,000 → You earned +2R

- Break even → 0R

Tracking your trades in R-multiples shifts your focus from monetary gain to risk-adjusted performance.

Over time, this helps you see the true edge of your strategy.

A string of +2R, +1R, -1R, +3R trades looks much healthier than tracking random rupee profits.

🎯 Why Risk Management is the First Step (Not the Last)

Let’s break down the real reasons why risk management must come before anything else—before strategy, before indicators, even before psychology.

1. It Keeps You in the Game

No capital = no trading. It’s that simple.

Even if you have a killer strategy, without capital preservation, one bad trade can wipe you out. You can’t learn or improve if you’re out of the market.

2. It Reduces Emotional Pressure

Knowing that you’ve already limited your risk brings emotional relief. You stop obsessing over outcomes because you’ve already accepted the worst-case scenario.

3. It Builds Long-Term Consistency

Professional traders don’t aim for jackpots. They aim for survivability and compounding over time. That’s only possible with consistent risk control.

4. It Protects You from Black Swans

Markets occasionally move violently due to events like war, elections, policy announcements. Risk management is your safety net when the unexpected hits.

🧠 Common Mistakes Traders Make with Risk

Let’s take a reality check. If you’re doing any of the below—pause and fix it immediately.

❌ No Stop-Loss

You’re hoping instead of managing. Hope isn’t a strategy.

❌ Risking Different Amounts on Every Trade

Your performance becomes inconsistent. You win big, lose bigger.

❌ Increasing Position Size After a Loss

Revenge trading kills accounts. One emotional trade can undo months of discipline.

❌ Risking More Than 2% Per Trade

Especially with smaller accounts, overleveraging can be fatal. Protect your downside first.

🧮 My Rule: The 1% Risk Model

one rule that changed everything for me:

Never risk more than 1% of your total trading capital in a single trade.

That means:

- If I have ₹1,00,000, I risk only ₹1,000–₹2,000 per trade.

- If I take a loss, I live to fight another day.

- If I win, I grow sustainably.

This may sound slow—but this is how professionals trade.

Slow. Controlled. Scalable.

🧰 Practical Risk Management Tips You Can Use Today

- Know Your Stop Before You Enter

- Don’t figure it out after entry.

- Define your “invalid point” based on technicals or logic.

- Don’t figure it out after entry.

- Use a Position Sizing Calculator

- Don’t guess. Let math decide how many shares/lots to trade.

- Don’t guess. Let math decide how many shares/lots to trade.

- Predefine Your Max Daily/Weekly Loss

- Hit that limit? Walk away. No emotions, no revenge.

- Hit that limit? Walk away. No emotions, no revenge.

- Track Every Trade in R-Multiples

- Build a habit of measuring consistency, not just wins.

- Build a habit of measuring consistency, not just wins.

- Never Add to Losing Trades

- Averaging down is a dangerous habit unless it’s part of a tested strategy.

- Averaging down is a dangerous habit unless it’s part of a tested strategy.

📖 A Lesson from My Own Journal

Back in 2011, I had a losing streak—7 trades in a row.

Old me would have doubled down, overtraded, and tried to “win it back.”

But this time, I stuck to my 1% rule.

Total drawdown: just 7%

I stepped back, reviewed my edge, and recovered in the next 10 trades.

That’s the power of discipline and risk control.

🧘♂️ The Psychology of Risk

You’re not just managing numbers—you’re managing fear, greed, ego, and hope.

Risk management helps you trade from a place of logic, not emotion.

It allows you to:

- Sleep peacefully knowing your exposure is limited.

- Stay calm during losses.

- Make rational decisions based on your plan, not your feelings.

🏁 Final Thoughts: Play Defense Before Offense

If I had to give one piece of advice to any trader—beginner or pro—it would be this:

Protect your capital like your life depends on it.

Because in trading, it truly does.

Every trade comes with uncertainty. But what’s always in your control is:

✅ How much you choose to risk

✅ Where you decide to exit if you’re wrong

✅ How many hits you’re willing to take before stepping back and reassessing

Success in trading doesn’t come from hitting a jackpot once.

It comes from consistently avoiding big mistakes—from building resilience, not just results.

And that journey starts with one powerful word: Risk.

💡 Want to sharpen your decision-making from the ground up? Start with strong fundamental analysis for stocks in Kothrud—because when your analysis is solid, your risks become calculated, not chaotic.