He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

Building Your Trading Foundation: Essential Terms and Concepts

I’ll never forget the day I blew up my trading capital almost entirely.

Painful? Absolutely.

Valuable? More than any course I’ve ever taken.

And that, my friend, was the moment I realized: Success in trading will only come by building a rock-solid foundation.

Whether you’re trading stocks, forex, or derivatives — your edge will always rest on a blend of knowledge, discipline, and risk control.

So let’s get to the heart of it. This blog is for you if:

- You’re new to trading and don’t know where to start.

- You’ve dabbled in markets but lack consistency.

- Or, you want to ensure your foundation is unshakable.

Let’s break down the key trading concepts that every trader must know—and how to apply them in real-world trading.

📚 1. Understanding Stock (or Asset) Selection

You can have the best strategy in the world, but if you pick the wrong stock or instrument—you’re going nowhere.

📌 What is Stock Selection?

It’s the process of identifying the right assets to trade based on specific criteria—volatility, trend strength, volume, sector performance, or news catalysts.

✅ What Makes a Stock (or Asset) Worth Trading?

- Volatility: Enough movement to offer profit potential.

- Liquidity: Tight spreads, low slippage, easy to enter/exit.

- Trend Structure: Clear patterns—either trending or ranging.

- News Sensitivity: How it reacts to earnings or events.

- Sector Correlation: Stocks in trending sectors often outperform.

🧠 Pro Tip:

Create a watchlist of fundamentally good stocks.

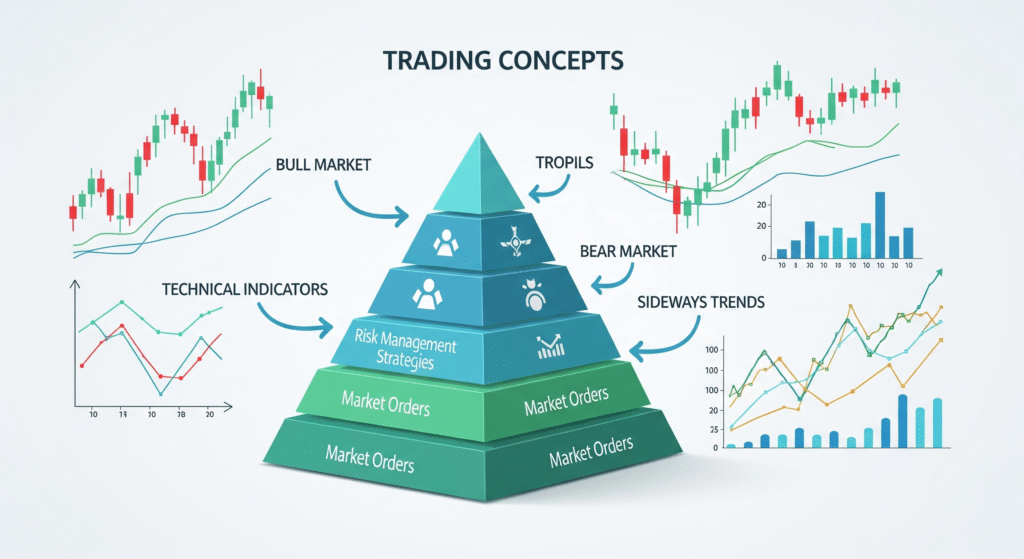

🧠 2. Mastering the Types of Market Analysis

Your analysis is your compass. Without it, you’re navigating blind.

There are three main types of market analysis, and each has its role.

📈 A. Technical Analysis

Analyzing price charts, indicators, patterns, and volume.

- Used For: Entry/exit timing, trend detection, support/resistance.

- Tools: Moving Averages, RSI, MACD, Price Action, Fibonacci, Candlestick Patterns.

✅ Pros:

- Works across all timeframes and assets.

- Helps visualize market psychology.

❌ Cons:

- Can produce conflicting signals.

- Requires practice and experience.

📊 B. Fundamental Analysis

Analyzing a company’s financials, earnings, industry trends, or macroeconomics.

- Used For: Stock valuation, long-term investment decisions.

- Data Points: EPS, P/E ratio, balance sheets, news, central bank decisions (in forex).

✅ Pros:

- Helps understand the “why” behind price movement.

- Crucial for investing or longer-term swing trades.

❌ Cons:

- Not useful for short-term trades.

- Data is sometimes lagging.

🧠 C. Sentiment Analysis

Understanding the mood of the market—greed, fear, uncertainty.

- Tools: VIX index, social media chatter, news headlines, option flows.

✅ Pros:

- Great contrarian signals when the crowd is overly bullish/bearish.

❌ Cons:

- Hard to quantify or rely on standalone.

🧭 Blended Approach Works Best:

Many experienced traders (including me) use technical analysis for timing and fundamentals for context.

“Amateurs focus on rewards. Professionals manage risk.”

— Alexander Elder

🎯 3. Entry and Exit Strategies

This is the “when” of trading—when to get in and when to get out. It’s not enough to be right—you need to be right at the right time.

🚪 Entry Techniques

A good entry gives you a favorable risk-to-reward ratio.

Examples:

- Breakout Entry: When price crosses a key resistance with volume.

- Pullback Entry: Buying into strength after a retracement.

- Reversal Entry: Spotting divergence or price exhaustion.

🚪 Exit Techniques

Exiting right is harder than entering. Greed often gets in the way.

Exit Methods:

- Target-Based: Set a pre-defined reward like 1:2 or 1:3.

- Trailing Stop: Ride trends while locking in profit.

- Exit on Signal Change: When your original setup breaks.

🎯 Golden Rule: Plan your exit before you enter.

🔐 4. Risk and Money Management

This is the safety net of trading. Without it, you’re just gambling.

📏 Risk Per Trade

How much are you willing to lose on a single trade? Most seasoned traders risk 1–2% of their capital per trade.

💼 Position Sizing

This is where pips and price per point come into play.

Your position size should be based on:

- Account size

- Stop-loss distance

- Risk tolerance

🛡️ Stop-Loss

A non-negotiable tool. It limits your losses. Use it religiously, not emotionally.

💸 Money Management Tips:

- Never risk more than you can afford to lose.

- Avoid revenge trading.

- Don’t add to losing trades hoping they’ll turn around.

- Always preserve capital. You can’t trade if you’re out of the game.

💬 One of my mentors once told me:

“If you focus on protecting your downside, the upside will take care of itself.”

That changed everything for me.

🧰 5. Key Trading Terms Every Beginner Must Know

Let’s run through a few non-negotiable trading terms that’ll come up almost daily:

| Term | Meaning |

| Pip | Smallest unit of price movement in forex |

| Spread | Difference between buy (ask) and sell (bid) price |

| Leverage | Borrowed funds to increase position size |

| Margin | Amount needed to open a leveraged position |

| Volatility | Degree of price fluctuation |

| Liquidity | Ease of buying/selling without affecting price |

| Stop-Loss | Predetermined price to cut losses |

| Take-Profit | Target price to lock in gains |

| Drawdown | Decline in capital after a loss |

You don’t need to memorize them all at once. But knowing them gives you the language of the market—and confidence.

⚖️ Pros and Cons of Being a Trader

✅ Pros:

- Financial freedom and flexibility

- No boss, no office politics

- Limitless learning and personal growth

- Can be scaled with skill—not just capital

❌ Cons:

- Emotionally exhausting at times

- Income is not guaranteed or consistent

- Self-discipline required—daily

- Loneliness if done without community or mentorship

This is why I always say: Trading is simple, but not easy.

🧠 The Emotional Side of Trading (And Why Most Ignore It)

You can master all the strategies, indicators, and tools—but if you can’t manage your emotions, you won’t last.

I’ve coached dozens of traders who knew more technical analysis than me—but couldn’t pull the trigger due to fear. Or they held on to losing trades due to ego.

🚨 Fear, greed, hope, revenge—these are your real opponents. Not the market.

What helps?

- Journaling your trades

- Having a written trading plan

- Taking breaks when emotional

- Joining a supportive trading community

You don’t just need a strategy. You need self-mastery.

So here’s my message to you—whether you’re just starting out or rebuilding after a tough phase:

Slow down to speed up.

Don’t rush into the next flashy strategy or indicator until you’ve truly internalized:

✅ How to select the right stocks or assets

✅ What type of analysis fits your personality

✅ How to enter and exit trades with clarity

✅ How to protect your capital through real risk management

These aren’t just textbook ideas—they’re the pillars of sustainable, stress-free trading.

And guess what? You don’t need to master everything in a week. Just lay one solid brick at a time.

💡 If you’re looking to truly understand the fundamentals, start your journey with expert-led forex trading courses near me in Kothrud. Sometimes, the right guidance is all it takes to turn confusion into confidence.

📝 Want to Go Deeper?

If this blog struck a chord and you’re ready to start building your trading foundation with structure, community, and mentorship, check out our Findependence Launch Program—designed specifically for beginners who want to get it right from day one.

Together, we’ll turn confusion into clarity—and strategy into success.

Written by:

Shantanu Joshi

Full-time Trader | Mentor | Founder, Findependence Trading Academy

18+ Years in Stock & Forex Markets