He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

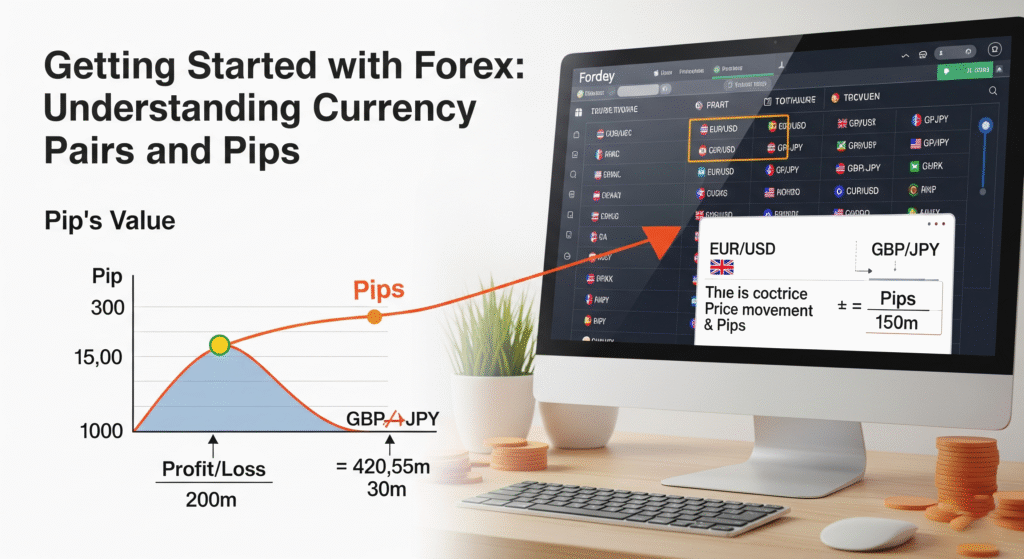

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

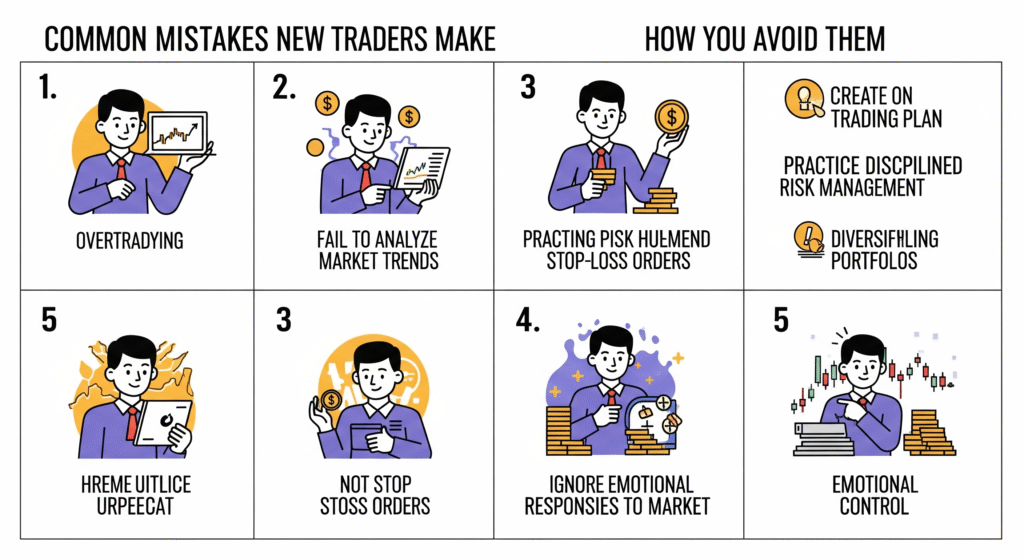

Common Mistakes New Traders Make (and How to Avoid Them)

I Wish Someone Told Me This When I Started

If I could go back and talk to my 2006 self—the excited, hungry, overconfident guy who thought he’d cracked the stock market—I’d sit him down and say:

“Slow down. It’s not as easy as it looks. And you’re going to make mistakes… but let’s make them only once.”

Back then, there weren’t many mentors, YouTube wasn’t a thing yet, and most of what I learned came from painful, expensive experience. Today, things are different. There’s information everywhere. And yet—traders still fall into the same traps.

I’ve worked with hundreds of new traders through my mentorship programs, and I see a pattern every single time.

Four mistakes keep repeating—over and over again.

In this blog, I want to walk you through those mistakes. Not as theory, but from the heart of someone who’s made every single one of them.

Mistake: Unrealistic Expectations

This is the biggest and the most dangerous trap.

When a new trader enters the markets, they’re often fueled by Instagram reels, profit screenshots, and flashy headlines:

- “Make ₹10,000/day from home.”

- “Grow ₹50K to ₹5L in 3 months!”

- “I made 200% in one trade—here’s how!”

What they don’t show is the months of losses, emotional stress, or the margin calls behind the scenes.

The truth? Most consistent traders aim for 2–5% monthly returns. That’s it.

If you aim to double your money every month, you’ll end up blowing your account instead. Because to achieve that, you’ll overtrade, overleverage, and overreact.

How to Fix It:

- Set realistic goals: Focus on consistency, not huge profits.

- Think in percentages, not rupees.

- Celebrate good execution, not just green P&Ls.

- Remind yourself: Trading is a career, not a lottery.

“In trading, you don’t rise to the level of your expectations—you fall to the level of your discipline.”

— Anonymous

Mistake: No Clear Trading Strategy

If I had a rupee for every time a new trader told me “I just follow the market,” I’d have retired already.

Let’s get real—you can’t trade without a system.

Whether you’re trading price action, indicators, or even news flow—you need to know:

- When to enter

- Where to exit

- What conditions invalidate your setup

- What your risk/reward should be

Without a defined strategy, you’ll end up chasing price, buying tops, selling bottoms, and being led by fear or greed instead of logic.

“No plan” is a plan—to lose.

How to Fix It:

- Pick ONE setup. Backtest it 100 times.

- Write down the rules. Treat them like traffic signals.

- Stick to that setup for at least a month before jumping to the next shiny thing.

- Use a trading journal to track your trades (we’ll talk more about this in another post).

Mistake: Lack of Discipline

This one is personal. Discipline isn’t just hard—it’s unnatural.

We humans are emotional creatures. The market punishes emotional decisions.

Here’s what lack of discipline looks like:

- Taking trades outside your plan

- Doubling position size after a loss

- Skipping stop-losses

- Revenge trading

- Cutting winners too early

And here’s the result:

Your capital goes down, and your confidence goes with it.

Discipline is what separates traders from gamblers.

And make no mistake—the market will test you. It will tempt you to break rules. It will throw losses at you. Your job isn’t to “beat the market.” It’s to stay grounded while others lose their minds.

How to Fix It:

- Create a trading checklist and follow it religiously.

- Use alerts and automation to reduce impulsive entries.

- Review trades weekly. Hold yourself accountable.

- Walk away after a red trade. Don’t trade to get even.

Mistake: Lack of Proper Knowledge

Let’s be honest: most people jump into trading without knowing the basics.

They know candlesticks, maybe RSI or MACD, but they haven’t studied:

- Market structure

- Position sizing

- Capital allocation

- News impact

- Risk management

They don’t understand that losing trades are part of the game, or that a good trader may be right only 50–60% of the time—but still be profitable.

I’ve seen people trade options without knowing what theta means. I’ve seen folks put 100% of their capital in one trade.

Trading without knowledge isn’t bravery—it’s negligence.

How to Fix It:

- Spend time learning before earning.

- Study books, mentors, and real-world charts—not just YouTube reels.

- Take a demo or small account and focus only on learning.

- Join a structured learning program if needed (like the one we offer at Findependence Academy).

Bonus Mistake: Neglecting Risk Management

I can’t skip this.

Even with a good strategy and discipline—if your risk management is off, it’s game over.

Trading 20% of your capital in one position?

No stop-loss because “this stock always bounces”?

Adding to a losing trade to average down?

That’s how accounts blow up.

Risk management isn’t about being conservative—it’s about being alive tomorrow.

How to Fix It:

- Risk only 1–2% of your capital per trade.

- Use hard stop-losses—don’t mentally “watch it.”

- Size your positions based on volatility and capital.

- Always ask: “If I’m wrong, how much will I lose?”

Real Trading is a Marathon—Not a 100-Meter Sprint

The mistakes we just talked about?

They’re not signs that you’re a bad trader. They’re just signs that you’re new.

But here’s the beautiful part:

You only need to learn the lesson once—if you’re willing to reflect and improve.

Don’t aim to be perfect. Aim to be aware.

Because once you become aware of these traps, you’ll start catching yourself:

- “I’m about to overtrade.”

- “This isn’t in my plan.”

- “That’s FOMO, not a setup.”

And that self-awareness?

That’s the beginning of real trading maturity.

Final Thoughts

You can read all the blogs and watch all the videos, but your growth as a trader depends on how you handle mistakes.

Let me leave you with one powerful idea:

Every mistake is a tuition fee. But repeating it—that’s just bad money management.

So take your time. Be kind to yourself. Learn the lessons early and deeply. Because the traders who survive—the ones who become consistent—aren’t the ones with the flashiest systems.

They’re the ones who avoided blowing up, one mistake at a time.If you’re looking to level up your skills and avoid common pitfalls, consider enrolling in forex trading courses in Pune. These courses can provide you with a structured approach to learning and a solid foundation in forex trading.