He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

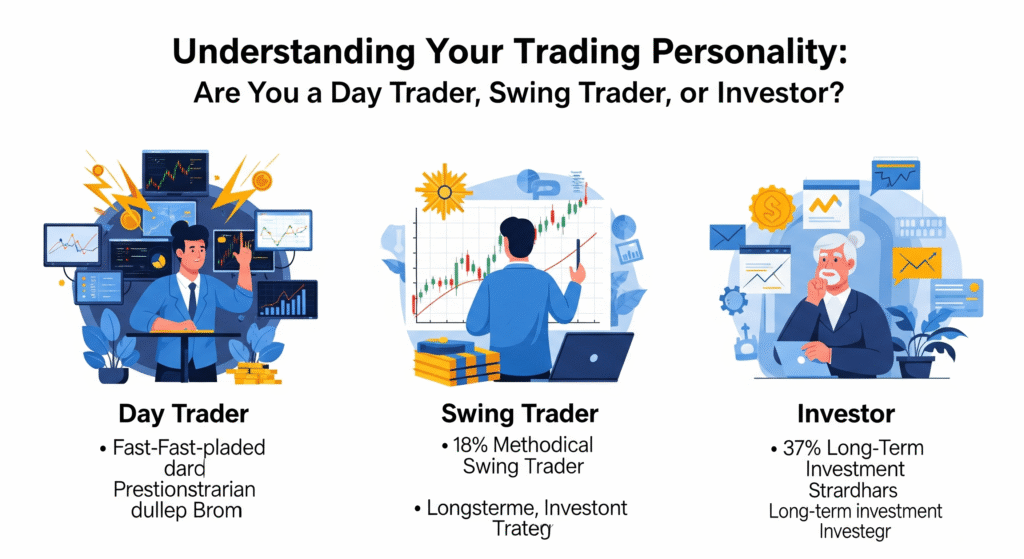

Understanding Your Trading Personality: Are You a Day Trader, Swing Trader, or Investor?

It took me almost three painful years to realize I was trading in a style that didn’t suit me.

Back in 2008, I was trying to day trade aggressively—scalping stocks and forex pairs with five-minute charts flashing red and green. My heart raced. My mind froze. I’d enter a trade and second-guess myself within 30 seconds. Profitable days felt like flukes. Bad days left me mentally wrecked.

It wasn’t until I took a step back and asked myself some honest questions—about my personality, risk tolerance, schedule, and emotions—that I finally realized something crucial:

The best trading style isn’t the one that’s most profitable. It’s the one that fits you best.

That was the turning point. I transitioned to swing trading, where I could hold trades for a few days, analyze charts in peace, and sleep without checking my phone every hour. And finally, the results followed.

So in this blog, let’s explore the three primary trading personalities: Day Trader, Swing Trader, and Investor.

We’ll look at:

- The core characteristics of each

- Timeframes they operate on

- Pros and cons

- How to figure out what suits you

🎯 Why Your Trading Style Matters

Choosing a trading style isn’t about what’s trending on YouTube or which influencer made money scalping this week. It’s about:

- Your emotional wiring

- Your available time

- Your risk appetite

- Your patience level

- Your learning curve

Trying to copy a style that goes against your personality is like trying to swim upstream.

You’ll feel drained, frustrated, and inconsistent.

Once you align your style with your nature, trading becomes smoother, decisions clearer, and results more stable.

Let’s now break down the three major trading archetypes.

“Know yourself. Know your edge. Trade accordingly.”

— Anonymous Trader Wisdom

⚡ 1. The Day Trader: The Fast-Paced Executor

🧠 Personality Type:

- Decisive

- Loves adrenaline and quick action

- Emotionally resilient and mentally agile

- Can focus for hours without distraction

⏳ Timeframes Used:

- Execution: 1-minute, 5-minute, 15-minute charts

- Context: 1-hour or daily chart

- Trade Duration: Seconds to a few hours (never held overnight)

🔧 Tools & Strategy:

- Momentum strategies, scalping, VWAP plays, news-based setups

- Tight stop losses and precise entries

✅ Pros:

- Quick results—win or lose, you know the outcome within hours

- Can trade multiple setups in a single day

- No overnight risk

❌ Cons:

- Emotionally and mentally exhausting

- Requires constant screen time

- High transaction costs and slippage

- Small mistakes get magnified

⚠️ Important: Don’t choose day trading just because you’re impatient.

Only do it if you enjoy fast decision-making and can stay calm under pressure.

🌀 2. The Swing Trader: The Strategic Timer

This is where I found my sweet spot. Swing trading allows a thoughtful, structured approach—without the chaos of minute-to-minute decision-making.

🧠 Personality Type:

- Patient but likes regular action

- Can wait a few days for a trade to play out

- Prefers part-time involvement but full-time discipline

⏳ Timeframes Used:

- Execution: 1-hour, 4-hour, daily chart

- Context: Daily or weekly charts

- Trade Duration: 1 to 10 days (sometimes longer)

🔧 Tools & Strategy:

- Trend-following setups, pullbacks, breakouts, mean-reversion

- Technical analysis, price action, volume, simple indicators

✅ Pros:

- Less screen time (ideal for working professionals)

- Clear structure and trade planning

- Lower stress and better sleep

- Higher risk-to-reward ratios (1:2, 1:3)

❌ Cons:

- Trades can turn against you overnight

- Requires patience and confidence in your setup

- Less frequent trading = FOMO if you’re impulsive

🔑 Key Insight: Swing trading is ideal for people who want consistent exposure to the markets but can’t (or don’t want to) sit in front of screens all day.

🏦 3. The Investor: The Big Picture Thinker

🧠 Personality Type:

- Long-term thinker

- Comfortable with slow growth

- Has emotional control and values fundamentals

- Focused on wealth building over years, not days

⏳ Timeframes Used:

- Analysis: Weekly, monthly, quarterly

- Trade Duration: Months to years

- Review Frequency: Once a week or month

🔧 Tools & Strategy:

- Fundamental analysis: earnings, valuation, macro trends

- Dollar-cost averaging, dividend investing, buy & hold

✅ Pros:

- Minimal screen time

- Lower stress and fewer decisions

- Historically strong long-term returns (especially in quality assets)

❌ Cons:

- Requires patience—returns can take years

- Big drawdowns possible in bear markets

- Limited flexibility during market volatility

💡 This style is perfect for people with full-time jobs, long-term goals, and a temperament for slow and steady wealth building.

📊 Comparison Table: Styles at a Glance

| Feature | Day Trader | Swing Trader | Investor |

| Time Commitment | Full-time | Part-time | Minimal |

| Holding Period | Intraday only | 1–10 days | Months to years |

| Risk per Trade | Low | Medium | Market-dependent |

| Stress Level | High | Moderate | Low |

| Decision Speed | Rapid | Measured | Rare |

| Tools Used | Price action, news | Tech charts, TA | Fundamentals |

🧠 How to Discover Your Trading Personality

Here are five key questions to help you decide:

1. How much time can you dedicate to trading each day?

If you have a full-time job or family responsibilities, day trading might not be practical. In fact, your available time is one of the most important factors in choosing your trading style.

- Day trading demands hours of screen time and constant attention.

- Swing trading can be managed with just 30–60 minutes a day.

- Investing requires minimal daily involvement, making it ideal for busy schedules.

Being honest about your time commitment will prevent burnout and help you choose a path that aligns with your lifestyle—not just your ambition.

2. How do you handle stress and fast decisions?

- Can you remain calm while the market moves against you?

- If not, a slower-paced style is better.

3. Are you naturally patient or impulsive?

- Impulsive traders often gravitate to day trading but struggle with discipline.

- Patient traders excel in swing trading and investing.

4. Do you enjoy analyzing charts or digging into company fundamentals?

- If you enjoy charts and patterns, swing or day trading fits.

- If you prefer reading reports and tracking macro data, investing may be your lane.

5. What’s your financial goal from trading?

- Short-term income → Day or swing trading

- Wealth creation over time → Investing

🙋♂️ My Own Evolution (A Personal Note)

When I started, I jumped straight into day trading.

Why? Because it looked exciting.

But over time, I realized I hated the constant pressure. It made me impatient, reactive, and burned out.

The moment I switched to swing trading—everything clicked. I had time to analyze trades, journal my thoughts, and manage my trades without constant panic.

Now, I help other traders discover their own trading style—not based on hype or trends, but based on their true nature and lifestyle.

You don’t have to trade like anyone else.

You have to trade like you.

🧭 Final Thoughts: Find Your Fit Before You Trade

The market is your battlefield, but your style is your weapon.

Before mastering the “perfect” entry technique or a foolproof risk strategy, pause and ask yourself:

“What kind of trader am I?”

There’s no one-size-fits-all in trading.

Each approach—day trading, swing trading, or long-term investing—comes with its own rhythm, rewards, and risks.

The real magic happens when your trading style aligns with:

✅ Your psychology

✅ Your daily lifestyle

✅ Your long-term goals

Once you discover that alignment?

Trading becomes less of a constant fight… and more of a refined skill.

💡 Ready to uncover your true trading style and sharpen it like a pro?

Start with expert-guided stock market courses in Kothrud—because real growth starts when you trade like you, not like everyone else.