He is a Full-time trader and Trading Mentor @ Findependence Trading Academy, with over 18 years of hands-on experience in the stock and forex markets. His journey from being a working professional to achieving financial independence through trading has inspired hundreds of aspiring traders to take control of their financial future.

His trading style revolves around identifying high-probability swing setups in equities and executing precise intraday trades in the forex markets. He treats trading like a business, where rules, clarity, and risk limits aren’t optional—they’re essential. He’s trained over 100+ traders through personalized coaching and structured programs, focusing not just on strategy but on building the mindset and systems that lead to long-term success.

A strong believer in keeping trading simple and practical, He shares real-world lessons drawn from market wins, losses, and years of evolving with changing conditions. He is also the author of “Getting Started with Technical Analysis” and a creator of custom TradingView indicators designed to give traders an edge.

When he’s not charting or mentoring, you’ll find him enjoying a game of Table Tennis.

Table of Contents

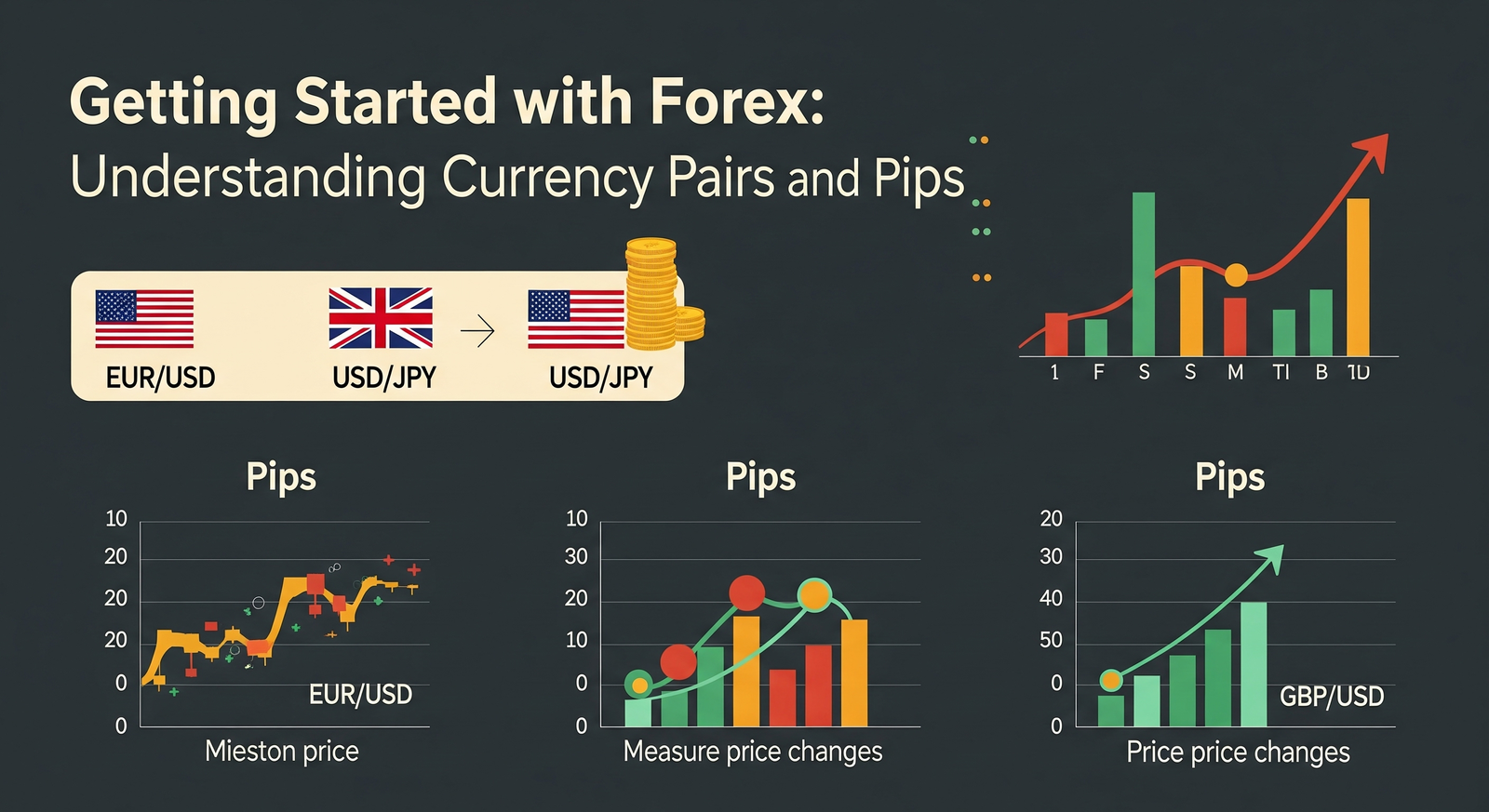

Getting Started with Forex: Understanding Currency Pairs and Pips

I still remember the first time I stumbled into forex trading.

My first reaction?

“Wait, what’s a pip? And why are these currencies always listed in pairs?”

That innocent curiosity was the beginning of an 18-year journey into the world of forex. Today, I’m going to pass that torch to you. If you’re a complete beginner, confused by all the jargon—don’t worry. By the end of this post, you’ll have a clear, intuitive understanding of currency pairs, pips, and why these concepts are the very foundation of your forex journey.

Let’s begin—step by step, just like I would teach a student in my academy.

🌍 What is Forex, Really?

Forex, short for foreign exchange, is the global marketplace where currencies are bought and sold. Think of it like a currency supermarket where traders (retail and institutional) speculate on one currency strengthening or weakening against another.

It’s the largest financial market in the world, with over $6 trillion traded daily. It’s open 24 hours a day, five days a week, and it never sleeps.

But unlike the stock market, you don’t trade “things” like companies—you trade currency pairs.

💱 The Heart of Forex: Understanding Currency Pairs

Here’s something that confused me when I started: “Why do currencies come in pairs?”

Well, it’s simple once you grasp the logic.

When you trade forex, you’re always exchanging one currency for another.

That’s why you’ll always see something like:

- EUR/USD

- USD/JPY

- GBP/INR

- AUD/NZD

Each currency pair has:

- A base currency (the first one)

- A quote currency (the second one)

So if EUR/USD = 1.1000, it means 1 Euro = 1.10 US Dollars.

✅ When you buy EUR/USD, you’re buying Euros and selling US Dollars.

✅ When you sell EUR/USD, you’re selling Euros and buying US Dollars.

It’s like traveling abroad. If you’re going from India to Europe, you’re exchanging INR to EUR. And when you return, you do the reverse. Forex trading is the same concept—just without the suitcase.

🔢 What is a Pip?

Ah, the mighty pip—short for “percentage in point.”

A pip is the smallest price movement in most currency pairs. For most pairs, 1 pip = 0.0001 (i.e., four decimal places). But for pairs involving the Japanese Yen, like USD/JPY, 1 pip = 0.01 (two decimal places).

Example:

If EUR/USD moves from 1.1000 to 1.1005, it moved 5 pips.

If USD/JPY goes from 110.00 to 110.25, that’s 25 pips.

But here’s the cool part:

Depending on your lot size, a single pip can be worth:

- $0.10 (micro lot)

- $1.00 (mini lot)

- $10.00 (standard lot)

So, yes—even a 10 pip move can mean $100 profit or loss if you’re trading standard lots.

That’s why understanding pips isn’t optional. It’s essential.

“In trading, as in life, you don’t need to be smarter than the rest. You need to be more disciplined than the rest.”

— Benjamin Graham

🧠 Why Do These Basics Matter So Much?

Let me tell you something very honest:

Most beginners skip the basics. They rush into strategies, indicators, and signals—but ignore currency pair dynamics and pip value.

And what happens?

- They blow their account because they didn’t size their positions right.

- They enter trades blindly, not realizing the volatility of certain pairs.

- They trade without knowing how much they’re risking per pip move.

“Forex is not about catching big trends. It’s about understanding small moves, and managing them well.”

And to manage those moves, you must know your pips.

📊 Categories of Currency Pairs

Let’s go a level deeper now.

Currency pairs are generally grouped into three categories:

1. Major Pairs

These include the most traded currencies in the world and always include the USD.

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

These pairs are:

- Highly liquid

- Lower spreads

- Great for beginners

2. Minor Pairs (Crosses)

These do not include the USD. Examples:

- EUR/GBP

- AUD/JPY

- GBP/JPY

They are still liquid, but may have slightly wider spreads.

3. Exotic Pairs

A major currency vs a currency of an emerging or smaller economy.

- USD/INR

- USD/TRY

- EUR/SEK

These can have high spreads and be more volatile—not ideal for beginners.

⚖️ Pros and Cons of Trading Major Currency Pairs

| Pros | Cons |

| Low spread and transaction cost | Can be less volatile during certain sessions |

| High liquidity = easy entry/exit | Market can become too efficient |

| Abundant analysis and data | Harder to get “edge” without strong discipline |

As a beginner, I’d advise you to start with 1 or 2 major pairs, like EUR/USD or GBP/USD. Master their behavior, and then explore others.

🎯 How to Calculate Pip Value (Simplified)

Let’s say you’re trading a standard lot (100,000 units) on EUR/USD.

1 pip = 0.0001

To calculate pip value:

Pip value = (0.0001 ÷ Current exchange rate) × Lot size

At EUR/USD = 1.1000:

(0.0001 ÷ 1.1000) × 100,000 = $9.09 per pip

So a 10-pip move = $90.90 profit or loss

Luckily, most brokers and trading platforms show this automatically. But understanding the math keeps you in control.

🚨 Mistakes Beginners Make

Let me share a few facepalm-worthy errors I made (so you don’t have to):

- Ignoring pip value before entering a trade.

- I once entered a trade on GBP/JPY without realizing its pip value was almost 1.5x that of EUR/USD. A 20-pip move wiped out 10% of my capital.

- I once entered a trade on GBP/JPY without realizing its pip value was almost 1.5x that of EUR/USD. A 20-pip move wiped out 10% of my capital.

- Trading too many currency pairs at once.

- It diluted my focus. Pairs have different behaviors—some trend, others range.

- It diluted my focus. Pairs have different behaviors—some trend, others range.

- Not accounting for spread.

- Some brokers charge 3-5 pips on exotic pairs. That’s like starting your trade with a handicap.

- Some brokers charge 3-5 pips on exotic pairs. That’s like starting your trade with a handicap.

Remember: Trading is a business. Every pip is your raw material. Know its worth.

🧭 How to Choose the Right Currency Pair as a Beginner

Ask yourself:

- Do I want volatility or stability?

- EUR/USD is more stable.

- GBP/JPY is a wild ride.

- EUR/USD is more stable.

- Am I trading during the London or US session?

- EUR/USD and GBP/USD are most active then.

- EUR/USD and GBP/USD are most active then.

- Can I handle drawdowns emotionally?

- If not, avoid pairs with wide daily ranges (like GBP/JPY).

- If not, avoid pairs with wide daily ranges (like GBP/JPY).

Start with 1 or 2 pairs. Journal everything. Observe how they behave during different times of the day. That’s how you build edge.

💡 Pro Tip from My Experience

Every currency pair has a personality.

- EUR/USD is calm, logical.

- GBP/USD has mood swings—be ready for drama.

- USD/JPY respects levels—until it doesn’t.

- GBP/JPY? It’s the rockstar that doesn’t care about your stop-loss.

Treat them like living beings. The more time you spend with them, the better you understand their behavior.

📘 Final Thoughts: Building a Strong Foundation

Before you dive into trading indicators or complex systems, slow down—and build your base.

✅ Understand what you’re trading (like the currency pair).

✅ Know how it moves (its volatility and pip value).

✅ Learn what each tiny movement truly means to your capital.

I’ve personally seen it happen—traders with flashy strategies fail, while those with simple setups succeed. The difference? The winners mastered the basics and never skipped the foundation.

If you deeply understand currency pairs and pips, you’re already ahead of 70% of beginners.

💡 At Findependence Academy, our stock market courses in Kothrud emphasize this very foundation—because lasting success is never built on guesswork, but on knowledge and clarity.

📝 Want to Go Further?

If this post gave you clarity and you’re ready to take your forex journey seriously, join my Forex Starter Blueprint at the Findependence Trading Academy. We go deep into live examples, pip-based risk management, and real-world trading execution.

Let’s build your trading foundation the right way.

Written by:

Shantanu Joshi

Forex & Stock Market Trader | Mentor | Founder, Findependence Trading Academy

18+ Years of Market Experience